how to pay indiana state taxes by phone

Generally if you owe 1000 or more in state and county tax for the year thats not covered by withholding taxes you need to make estimated tax payments throughout the year. Depending on the amount of tax you owe you.

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

How do I pay my Indiana state taxes by phone.

. Find Indiana tax forms. Call 317-232-2240 or go to httpsintimedoringoveServices to set up a payment plan with the Indiana Department of. Depending on the amount of tax you.

If you have the funds available to pay your tax. Depending on the amount of tax you. Find out how to pay estimated tax.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Welcome to INtax Pay the states online tool for paying your balance in full or establishing a payment plan for your unpaid tax bills. You can pay online by visiting httpsintimedoringoveServices.

Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. Know when I will receive my tax refund. Pay Your Property Taxes.

Make a payment without logging in to INTIME. Corporate Income Tax Customer Service-Customer Contact 317-232-0129 County Innkeepers Tax Customer Service-Customer Contact 317-232-2240 Estate Tax Legal 317-232-2154. Locate the Bill payments section.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov.

If you have an account or would like to create one or if you. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. Pay my tax bill in installments.

Claim a gambling loss on my Indiana return. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. Select Bank Payment no fee or Credit Card fee.

The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME. Pay Location Code Name City State or Zip Code.

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

Indiana Sales Tax Small Business Guide Truic

Business Income Taxes In Indiana Who Pays

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

How Taxes Work Taxes Social Security Numbers Visas Employment Office Of International Affairs Indiana University Purdue University Indianapolis

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Free Tax Preparation Offered For Low Income Clients In Southern Indiana

Indiana State Tax Information Support

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Sales Tax Laws By State Ultimate Guide For Business Owners

Indiana Tax Refund Here S When You Can Expect To Receive Yours

How We Got Here From There A Chronology Of Indiana Property Tax Laws

![]()

An Indiana Tax Lawyer Explains Irs Installment Plans State Payment Options Camden Meridew P C

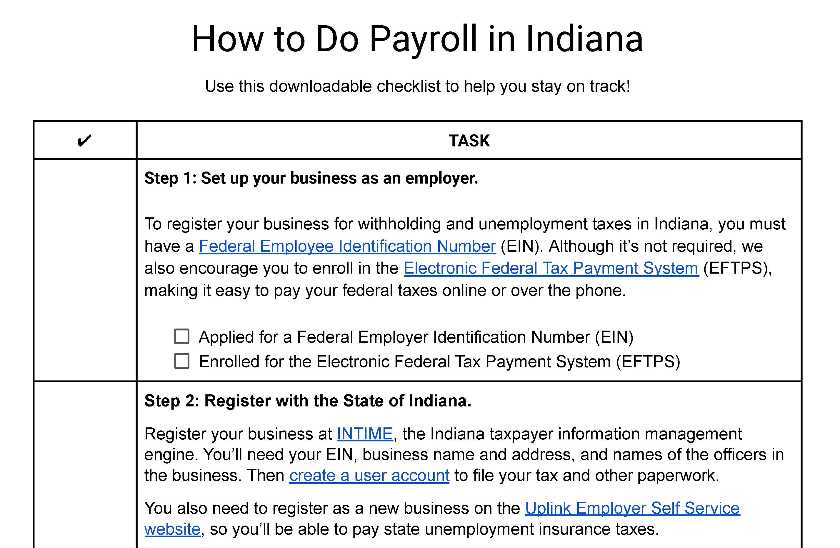

How To Do Payroll In Indiana What Every Employer Needs To Know

Indiana 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Indiana Democrats Renew Push For Gas Tax Suspension Amid Record High Prices

The Republican Supermajority Extremism And Neglect By The Numbers Spencer County Democratic Party